Africa is no longer just the “next frontier” for entrepreneurship it is actively becoming a leading stage. With over 60 % of the population under age 25, and with rapidly improving mobile, internet and digital‐payment infrastructure, the continent presents one of the richest entrepreneurial canvases in the world today. Afrikan In this article for Bidaya, we explore how African entrepreneurs are building tomorrow’s industries fintech, agritech, climate tech and more what’s working, where the challenges are, and what global investors and business leaders should watch.

Why the Momentum – The Drivers of Entrepreneurial Growth in Africa

Africa’s entrepreneurial surge rests on several converging factors. First, demographic advantage: over 60 % of the population is under 25, creating both talent and demand.

Second, digital infrastructure is maturing: mobile money and internet penetration are enabling new business models.

Third, funding flows are increasing: investment into African tech startups has grown significantly.

Data point: According to the 2024–25 Global Entrepreneurship Monitor (GEM) report, while fear of failure is rising globally (49% of respondents say it would stop them starting a business) many African economies still show high levels of opportunity perception, albeit with caveats.

Real example: In Kenya alone, as one report shows, entrepreneurship in health-tech, fintech and agritech is growing fast as young founders respond to local problems.

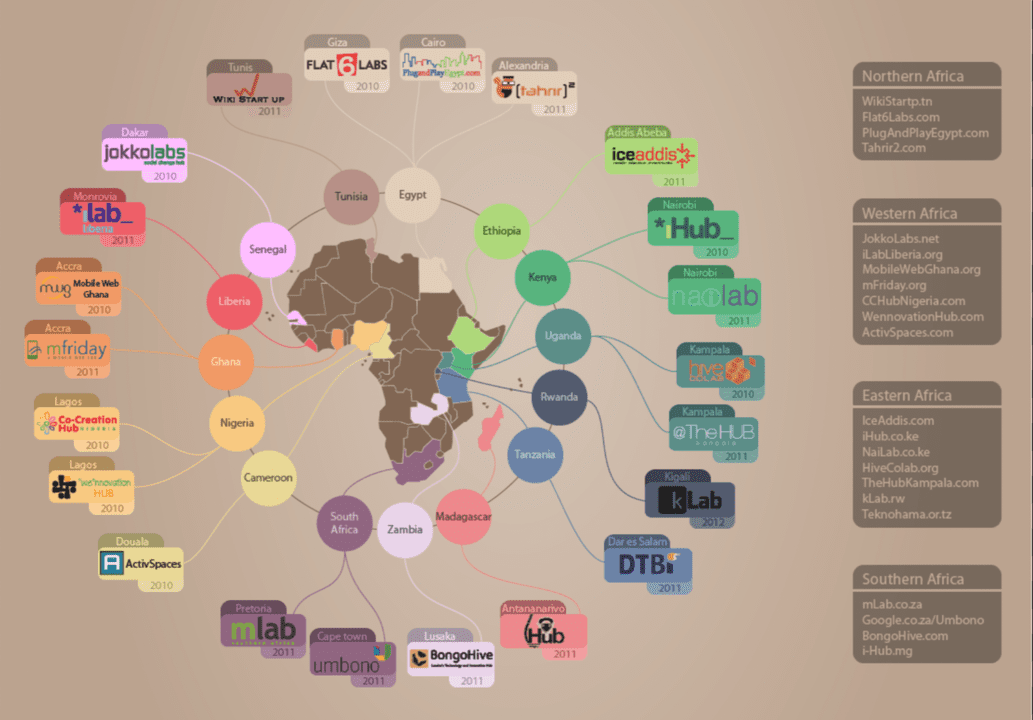

Why this matters for global business: For multinational firms, development agencies and investors, Africa’s dynamism signals not only new markets, but new innovation ecosystems. Startups in Lagos, Nairobi or Accra are increasingly building scalable models that can be exported.

Key Sectors – Fintech, Agritech & Climate Tech

Fintech

This remains the heartland of Africa’s startup boom. One recent article finds that fintech and software companies account for nearly 40% of the top 130 fastest-growing African firms in 2025. Financial Times

Another shows Kenya had 102 fintech firms in 2023 (about 15% of Africa’s total), and Nigeria leads with 217 (32%).

Case study: Iyinoluwa Aboyeji co-founded Andela and later Flutterwave two firms that show how African founders are moving from “local problem” to “global platform”.

Agritech & Food Systems

Technology is being deployed to improve productivity, supply-chains, market access for farmers and rural communities. For example, mobile-based services and USSD/Android hybrid systems are emerging in rural Tanzania to link smallholders to markets.

Climate Tech / Green Innovation

Entrepreneurs are increasingly focused on climate resilience and sustainability: solar mini-grids, off-grid power, circular economy solutions. In Kenya and Nigeria, studies showed solar minigrids significantly boosted incomes and gender equality in rural households.

Case study: Joseph Nguthiru, a Kenyan engineer, founded HyaPak, which turns invasive water-hyacinth into biodegradable packaging, an example of “entrepreneurship meets ecology”.

Spotlight: Entrepreneurial Trailblazers

Nigeria – Fintech & Payments

Tosin Eniolorunda, founder of Moniepoint Inc. (formerly TeamApt), exemplifies Nigeria’s fintech ascendancy. Moniepoint provides business banking and payments. Eniolorunda has been named among Africa’s influential tech entrepreneurs.

PalmPay, another Nigerian mobile-payments firm, boasts 35 million users and recent funding rounds, showing how scale is emerging.

Kenya – Circular Economy & Sustainability

Alex Mativo, Kenyan entrepreneur, founded E-LAB (e-waste to fashion/interiors) and Duck (AI & retail analytics). His story shows how African founders are moving beyond fintech into creative, sustainable models.

Joseph Nguthiru, founder of HyaPak, addresses environmental problems with entrepreneurship turning invasive water-plants into packaging.

Pan-Africa / Emerging Markets

The rollout of African Continental Free Trade Area (AfCFTA) and improved intra-African connectivity are enabling startups to think regionally rather than locally.

Challenges & Obstacles

While the narrative is powerful, the reality includes persistent obstacles.

Infrastructure and Access

Many entrepreneurs still face unreliable power, slow internet, and logistical hurdles. A recent review notes that infrastructure deficiencies remain a key barrier for entrepreneurship in Africa.

Funding and Distribution

Although capital is increasing, it remains concentrated: four countries (Nigeria, South Africa, Kenya, Egypt) received 90 % of venture funding in 2024.

Gender and Inclusion

Women entrepreneurs face additional barriers. For example, access to internet and mobile data remains costlier for women in developing economies 45 % of women said they lacked regular internet access due to cost.

Scaling Regionally

Scaling from one country to continent-wide remains difficult because of regulatory heterogeneity, fragmented markets and logistical costs.

What This Means for Investors, Corporates & Ecosystem Builders

For global investors and corporations, the African entrepreneurial surge holds several implications:

- Early mover advantage: Entering ecosystems now can yield strategic partnerships with startups that may become continental scale-players.

- Localized solutions: African founders are addressing local constraints (e.g., mobile wallets for the unbanked) which may become global templates.

- Sustainability link: Many business models are tied to climate and social goals (agritech, renewables, inclusion) offering blended-value returns.

- Regional thinking: With AfCFTA and better connectivity, startups are aiming for regional footprints investors should plan accordingly.

- Risk mitigation: Given infrastructure, regulatory & macro challenges, rigorous due-diligence and local partnerships are essential.

Conclusion

Africa’s entrepreneurial moment is here. From fintech hubs in Lagos to circular-economy innovators in Nairobi, a new generation of founders is building the future with global relevance. The interplay of youth, digital tools, regional markets and bold business models is transforming the narrative. Yet infrastructure gaps, funding concentration and inclusive access remain real. For the entrepreneur, investor or corporation willing to engage, the message is clear: Africa is not just an opportunity zone it is a source of global-scale innovation.

Actionable Takeaways

- Map which African markets align with your sector (fintech, agritech, climate tech) and localise your strategy.

- Partner with leading local entrepreneurs or hubs to navigate regulatory and market complexity.

- Design for inclusion gender, rural/urban divides, and affordability matter.

- Think regionally from Day One markets across Africa are increasingly interconnected.

- Monitor infrastructure metrics (connectivity, power, logistics) as part of your risk/return calculus.