Climate tech is undergoing a fundamental realignment. After a decade defined by moonshot ambitions and planet-first messaging, founders and investors are embracing a new thesis: climate solutions must be profitable to be scalable. The sector’s earlier narrative leaned heavily on moral urgency, but today’s market rewards business models backed by strong unit economics, recurring revenue, and measurable customer value.

In the past two years, economic headwinds, rising interest rates, and competition for capital have forced climate innovators to adopt a more disciplined financial posture. As one venture partner at MCJ Collective put it, “Impact without returns is philanthropy; venture-backed climate tech must generate both.” This shift is not a retreat from mission. Instead, it is a recognition that profitability is the engine that powers durable climate impact.

The Investment Landscape Has Fundamentally Changed

By 2023–2024, global climate tech investment had cooled from its 2021 peak. According to PwC’s State of Climate Tech report, funding dropped roughly 40 percent year over year as investors recalibrated expectations. Strategics and late-stage capital became more selective, prioritizing solutions with clearer pathways to commercial adoption.

This contraction did not signal lost interest in climate solutions; instead, it exposed a mismatch between early climate narratives and the financial realities of venture-backed growth. Investors now gravitate toward models that perform under traditional business scrutiny. Examples include B2B carbon-accounting platforms with sticky enterprise contracts, electrification infrastructure companies generating recurring service revenue, and hardware firms pairing devices with long-tail software monetization.

Data point: In 2024, more than 70 percent of climate tech funding went to companies with revenue-generating business models rather than speculative R&D, according to BloombergNEF.

The market’s message is clear: purpose attracts attention, but profits secure capital.

Why the Profit-First Pivot Strengthens, Not Weakens, Climate Impact

For years, climate founders worried that commercial prioritization would dilute mission. Yet evidence suggests the opposite. When climate tech firms become profitable, they scale faster, survive downturns, and capably deliver measurable emissions reductions.

To illustrate, consider the rapid rise of Heat Pump manufacturers in Europe. As energy prices spiked in 2022, commercially competitive heat pump solutions saw record adoption. The companies leading the charge were not those with the greenest branding but the ones offering superior economics: lower installation costs, higher efficiency, and clear ROI for homeowners.

Similarly, fleet electrification has accelerated primarily because electric trucks now offer operational savings. When PepsiCo electrified portions of its delivery fleet in 2023, the decision was guided by cost avoidance and logistics efficiency as much as emissions targets.

Expert insight: As Jigar Shah, Director of the US Department of Energy’s Loan Programs Office, frequently argues, the climate transition will be won by technologies that “beat fossil fuels on price, convenience, and reliability first.”

In other words, the planet benefits most when climate tech becomes the obvious economic choice.

The New Rules of Building a Climate Tech Business

Today’s climate entrepreneurs face a different playbook from the exuberance of 2020–2021. The companies attracting capital share several characteristics:

1. Unit Economics Before Vision Decks

Founders now lead with CAC, payback periods, and margin profiles. Climate startups with clear cost advantages over incumbents are closing rounds faster than narrative-driven moonshots.

2. Commercial Pilots That Prove Value, Not Just Feasibility

Enterprise buyers demand short deployment cycles and demonstrable savings. Carbon capture firms like Svante and Climeworks have transitioned from prototype demos to multi-year commercial contracts, showing investors that buyers are willing to pay.

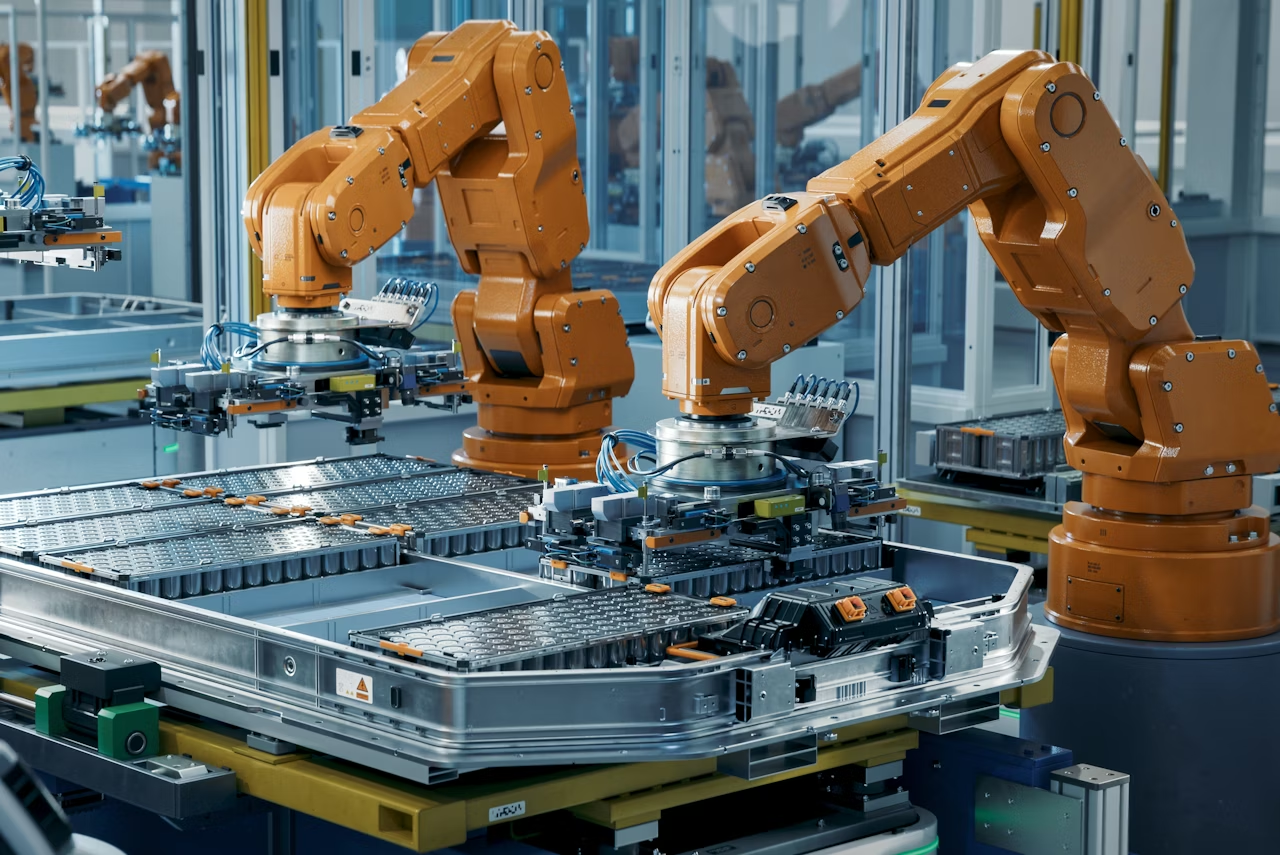

3. Hybrid Business Models Blending Hardware and Software

Hardware-enabled software revenue has become a hallmark strategy. Solar monitoring firms like Aurora Solar and EV charging startups like Wallbox earn recurring subscription revenue on top of installed hardware, increasing lifetime value.

4. Regulatory Tailwinds Are a Bonus, Not the Core Thesis

Governments worldwide from the US Inflation Reduction Act to the EU’s Fit for 55 package continue to create incentives. But investors now treat policy as additive. Companies must stand on their own economics.

Data point: McKinsey’s 2024 climate finance review notes that climate solutions that deliver a 3 to 5 year ROI grow adoption rates up to 4x faster than those relying primarily on subsidies.

Case Studies: Profitability as the Pathway to Scaled Impact

Case Study 1: Tesla’s Multi-Pronged Profit Engine

Tesla’s early vision was climate-driven, but its long-term success came from mastery of cost curves. Battery costs declined nearly 90 percent from 2010 to 2023, enabling mass-market vehicles at attractive margins. Profitability unlocked global scale, driving EV adoption far faster than policy mandates alone.

Case Study 2: Enpal’s Subscription Solar Model in Germany

Enpal became Germany’s first solar unicorn by turning rooftop solar into a subscription service. The company’s model minimized upfront cost for homeowners while securing predictable monthly revenue. By 2024, it had deployed more than 100,000 systems, proving that climate impact accelerates when business incentives align with consumer behavior.

Case Study 3: Carbon Removal Marketplaces Turning Profit

Companies like Carbonfuture and Patch have shifted from voluntary offsets to verifiable, premium removals with transparent MRV. Instead of chasing volume, they built profitable marketplaces that attract enterprise buyers seeking high-integrity credits.

What This Shift Means for Founders, Investors, and the Planet

A profit-first orientation is not a moral downgrade; it is a strategic necessity. Climate goals require trillions in capex and global behavioral change. Philanthropy cannot fund that scale. Venture capital cannot justify it without returns. Public markets will not reward it without predictability.

The winners in the next wave of climate tech will be those that deliver immediate economic value while enabling long-term decarbonization. These companies will attract better talent, close more enterprise deals, and weather market cycles.

Forward Outlook:

Expect to see:

- A rise in climate tech IPO candidates built on solid balance sheets.

- More corporate-climate partnerships driven by cost savings rather than ESG checkboxes.

- Growth in climate verticals where margins are improving fastest, such as grid software, industrial automation, and climate-resilient materials.

Profitability is not the opposite of impact. It is the accelerant.

Conclusion: Climate Tech’s New Era Requires Business Discipline

Climate tech is entering its maturity phase. The sector no longer relies on optimism alone. It is powered by commercially competitive solutions that solve real customer problems. Founders who embrace disciplined financial strategy will create the most enduring environmental outcomes. Investors who prioritize unit economics will unlock the next generation of climate unicorns.

The planet wins when climate solutions win in the marketplace.