The Founder’s Dilemma: To Pay or Not to Pay

One of the hardest questions new entrepreneurs face is when and how to start paying themselves. Many founders delay taking a salary, believing every dollar should go back into the business. Others pay too much too soon, putting the company at risk.

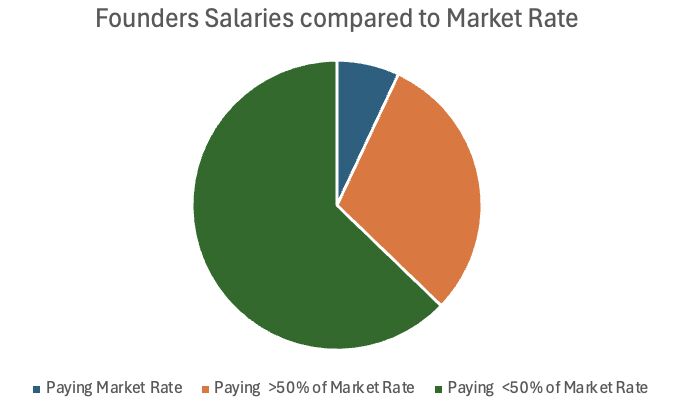

According to a 2023 Kruze Consulting survey, early-stage startup founders pay themselves an average of $50,000 to $75,000 annually far less than corporate executives. The reality is, finding the balance between personal needs and company growth is key.

Covering Basic Living Costs First

Smart founders prioritize covering essential living expenses before anything else. Rent, food, healthcare, and family needs are the baseline.

This is not about luxury but about survival. If a founder cannot afford to focus on the business because of financial stress, the company suffers too.

Lesson: Pay yourself enough to live, not enough to coast.

Percentage-Based Salary Models

Some founders tie their pay directly to revenue. For example, taking 10–20% of net profits ensures that compensation grows as the business does. This keeps founder incentives aligned with performance.

This method also prevents overspending during lean months and rewards success during strong ones.

Lesson: Link your income to the company’s health.

Paying in Equity or Deferred Compensation

Instead of a large salary upfront, many founders take equity or defer part of their pay until the business becomes profitable. This builds long-term wealth while protecting cash flow.

Stripe and Airbnb’s early founders took modest salaries but significant equity, which later turned into billions.

Lesson: Future equity often outweighs early salary.

Setting Salary Benchmarks

Savvy founders research salary benchmarks by industry and region. Consulting firms and databases like Glassdoor or Kruze provide insights into typical founder compensation.

Knowing where you stand avoids both underpaying yourself and overspending company funds.

Lesson: Data-driven salaries keep emotions out of pay decisions.

Reinvesting First, Rewarding Later

The smartest founders often reinvest heavily in the early stages, choosing growth over personal income. Instead of big paychecks, they fund marketing, hiring, or technology improvements.

This sacrifice pays off when the company scales, and future salaries can be much higher.

Lesson: Sometimes the best paycheck is patience.

Conclusion: Pay Smart, Grow Smarter

How much a founder pays themselves is less about numbers and more about priorities. Cover basic needs first, align pay with growth, and consider equity for the long game. The smartest founders understand that disciplined compensation today creates massive wealth tomorrow.

The rule is simple: pay yourself just enough to stay focused, then let the business fund the future you are building.

FAQs

1. When should a founder start paying themselves?

As soon as the business generates enough revenue to cover essential living costs without harming growth.

2. How much do startup founders usually pay themselves?

Surveys show early-stage founders typically earn between $50,000 and $75,000 annually.

3. Should founders take equity instead of salary?

In the early stages, equity often creates more long-term wealth than a high salary.

4. Is it bad to pay yourself too little?

Yes. If financial stress affects focus and performance, the business suffers.

5. How do investors view founder salaries?

Most investors prefer modest salaries that show discipline while ensuring founders can sustain themselves.