As we step into 2025, investors face a complex landscape of moderate growth, shifting policy levers and evolving technology. The key question: Where is smart money moving next? From major institutional houses to nimble hedge funds, capital is being repositioned in response to inflation, globalization-fragmentation, and the broad deployment of artificial intelligence (AI). This article will map the major themes, strategies and opportunities guiding smart-money flows in 2025, offering business-savvy readers a lens to anticipate the next wave of investment.

Global Macro & Policy Backdrop

Shifting growth and policy dynamics

Global growth in 2025 is expected to be modest. For example, Deutsche Bank forecasts U.S. GDP at ~2.0 % while the Eurozone lags at ~0.9 % and China around 4.2 %. Wealth Management Services

At the same time, there’s a clear pivot: monetary-policy dominance is giving way to fiscal-policy emphasis—governments are stepping up infrastructure, defence and technology spending. Wealth Management Services+1

What this means for investors:

- With central banks less able to catalyse growth via big rate cuts, portfolio strategies must account for structurally higher rates and more frequent policy surprises.

- Efforts to boost productivity via technology and infrastructure suggest long-term winners among firms that can leverage these trends.

Regional divergence & currency implications

Outside the U.S., growth is improving in parts of Asia and Europe, and assets denominated outside the U.S. dollar are gaining attention. For instance, the Invesco mid-year outlook highlights non-U.S. equities, non-U.S. bonds and emerging-market (EM) assets as increasingly attractive.

With the U.S. dollar facing weakness, diversification into other currencies and regions may provide a buffer.

Data Point: In one survey, ~60% of trade-finance firms reported higher volumes over the past year and ~73% expect further increases in the next 12–18 months an indicator of supply-chain realignments.

Where Smart Money Is Allocating Capital

1. Equities: A Tilt Toward Non-U.S. and Select Themes

Smart money is increasingly looking abroad. According to Invesco:

“Non-US assets are increasingly attractive and poised for continued out-performance.” Invesco

For example:

- European, UK and Asian equity markets are being favoured.

- Within equities, sectors linked to productivity and technology are key—especially firms deploying AI, cloud and semiconductors.

- Small- and mid-cap stocks are getting renewed interest as rate pressures ease and growth becomes more broad-based.

Case Study: The tech sector in the U.S. now accounts for roughly one-third of S&P 500 earnings three times its share 20 years ago.

However, valuations are stretched: the S&P 500’s forward P/E ratio is near 23x, while some non-U.S. markets trade at a discount.

Key takeaway: Smart money is not abandoning equities it is simply becoming more selective: favouring growth themes, non-U.S. markets, and stocks that can live up to their valuations.

2. Fixed Income & Credit: Yield Still Matters

With yields at elevated levels and inflation still a concern, fixed-income is getting a nuanced rewrite:

- Investment-grade corporate bonds remain attractive given income plus term premium.

- Emerging-market bonds in local currency are gaining traction, especially in environments where the dollar weakens.

- Duration management is crucial: in a world where rates may stay higher for longer, blind long-duration bets are riskier.

3. Alternatives & Real Assets: Diversification Under Pressure

Traditional 60/40 portfolios face headwinds when stocks and bonds move in tandem. Smart money is therefore shifting toward:

- Infrastructure and private credit assets that benefit from the fiscal-policy shift and higher productivity investment.

- Commodities and industrial metals especially as supply-chain reconfiguration and green-transition dynamics take hold.

- Liquid alternatives and hedge strategies given that diversification via stocks/bonds alone is less effective in the current regime.

Example: Deutsche Bank cites infrastructure (public and private) as one of its 2025 “asset-class themes for growth”.

4. Thematic Investments: Productivity, AI, Climate, Restructuring

Smart money is not just allocating to asset classes, it’s also allocating to themes:

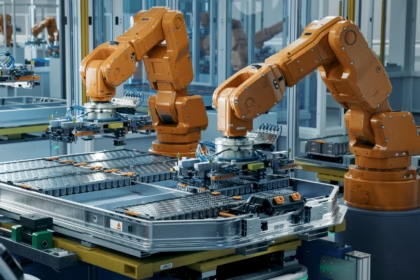

- The productivity upgrade: Technology (especially AI) is seen as a structural lever for productivity improvement and hence investment return.

- Environmental/social/governance (ESG) and climate-transition themes are gaining ground, especially in emerging markets supported by big-data adoption.

- Global trade and supply-chain restructuring: Firms that benefit from reshoring, regionalisation or trade-flow rerouting are on investors’ radars.

Risks to Monitor

Smart money knows the upside but also the traps. Key risks in 2025 include:

- Sticky inflation and policy misstep: If inflation remains high and central banks misread signals, both stocks and bonds could face pain.

- Valuation risk in tech/growth: Strong earnings drive valuations today but if growth disappoints, corrections may follow.

- Geopolitical and trade disruptions: Elevated tariffs, fragmented global trade and supply-chain shocks are unpredictable wildcard risks.

- Correlation breakdowns: The usual diversifiers stocks vs bonds may not behave as in past decades, demanding creative portfolio construction.

Actionable Takeaways for Entrepreneurs & Investors

- Diversify regionally: Don’t concentrate solely on U.S. equities. Consider exposure to Europe, Asia and emerging-markets where valuations and momentum look favourable.

- Be selective in equities: Focus on companies with demonstrable productivity gains, strong cash flows and exposure to structural themes like AI, sustainability and infrastructure.

- Balance your fixed-income exposure: Use the yield premium in credit and selective emerging-market bonds but keep duration under control.

- Add real-asset and alternative exposures: Infrastructure, private credit, and commodities are no longer niche they’re portfolio essentials.

- Watch valuations and policy shifts: Stay alert for policy surprises (trade, fiscal, regulatory) and overvalued sectors smart money isn’t blindly chasing hype.

- Build flexibility: Given the complex outlook, use flexible mandates and dynamic asset allocations rather than static models.

Conclusion

In 2025, the smart money is moving not towards the path of least resistance but toward the path of highest conviction. That means selecting regions, asset classes and themes with structural tailwinds. Growth is moderate, policy is shifting, and markets are more complex than in years past. But where there is change, there is opportunity. For investors and entrepreneurs alike, the message is clear: stay invested, stay selective, and stay flexible.